Accounting Services

We provide startup counselling, bookkeeping and year-end financial reporting.

Tax Matters

We provide tax services for individuals, partnerships, trusts and corporations.

Corporate Finance

We provide operation management, planning and budgeting, capital raising and M&A services.

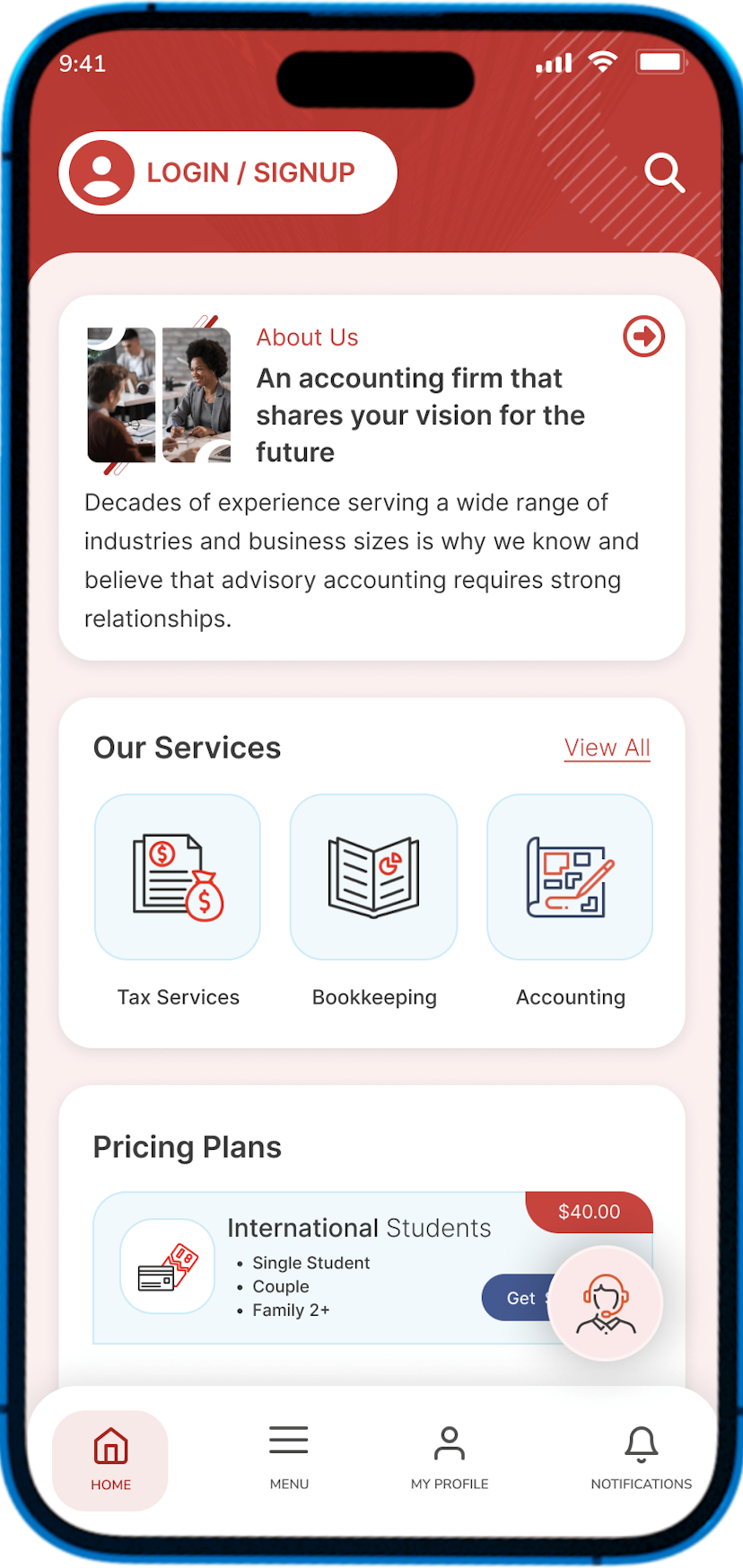

An accounting firm that shares your vision for the future

Decades of experience serving a wide range of industries and business sizes is why we know and believe that advisory accounting requires strong relationships.

Taxation

Providing innovative tax planning solutions

Advisory

We always ensure to provide our best for our customers

Services We Provide

Tax Services

We take into account current tax and business factors and covers most services.

Accounting

Accounting is giving you a meaningful foundation for your business decision processes.

Bookkeeping

The bookkeeping is to make sure that all transactions are recorded accurately.

Business Planning

With extensive requirement, our goal is to add value to your daily operations.

Asked Any Questions

https://www.canada.ca/en/revenue-agency/services/e-services/e-services-businesses/business-account.html

Free Consultation

Our Client Reviews

We have been coming to them for a couple years now for our taxes. Mandeep and the whole team were friendly and professional. Their follow up and good customer service make the process smooth. I'd recommend them!

We had a great experience working with Mandeep. The entire process was fast and easy. The team made sure to file my taxes accurately and I would recommend her to anyone looking for tax assistance.